Introduction

If you’ve been researching ways to improve your financial health, boost your credit, or access better borrowing opportunities, you’ve probably come across Creditvana. As more people look for fast, reliable, and transparent financial tools, Creditvana has started gaining attention — but what exactly is it, how does it work, and is it actually worth using?

In this guide, we break down everything you need to know about Creditvana, including how it works, its benefits, potential drawbacks, and the real experiences users are sharing online. Whether you’re trying to build your credit from scratch, repair past financial mistakes, or simply exploring new tools to manage your credit profile, understanding what Creditvana offers can help you make a smarter decision.

By the end of this review, you’ll know whether Creditvana is a good fit for your financial goals, which alternatives you should consider, and how to get started if you decide it’s right for you. Let’s dive in.

1. What is Creditvana? — Overview and Definition

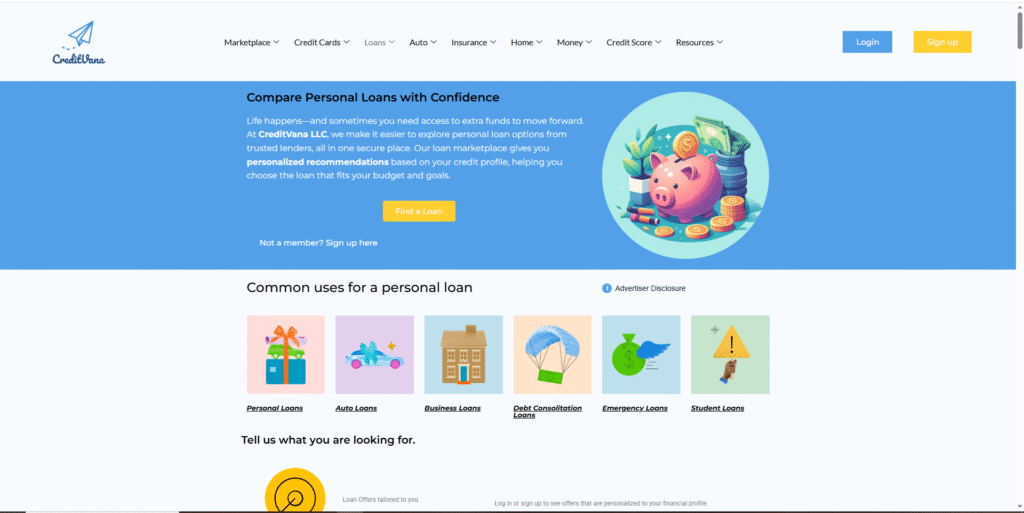

- Introduce the concept/service behind “Creditvana.”

- What does Creditvana offer / what is it supposed to do.

2. Why Creditvana Matters — Benefits & Use-Cases

- Scenarios when Creditvana is useful (financial help, credit building, loans, etc).

- Who might benefit from using Creditvana (e.g. people with bad credit, first-time borrowers, small business owners).

3. How Creditvana Works — Mechanism, Requirements, Eligibility

- What is required to use Creditvana (documentation, credit history, application steps).

- The typical process flow (apply → approval → funding / credit line / whatever Creditvana delivers).

- Fees, interest rates, repayment terms, user obligations.

4. Pricing, Fees, and Interest Rates

- Breakdown of costs associated with using Creditvana (fees, APR, hidden charges).

- Comparison to alternatives or benchmarks (if available).

- Transparency and trustworthiness of their pricing model.

5. User Experience & Customer Support

- Ease of use (application interface, user-friendliness).

- Speed of approval / funding.

- Customer support channels, responsiveness, reliability.

6. Eligibility & Accessibility — Who Can Use It & Where

- Geographic coverage (countries, regions) — whether Creditvana is global or region-limited.

- Credit score or other eligibility requirements.

- Accessibility for underserved or underbanked populations (if relevant).

7. Security and Privacy — Data Protection, Compliance, Risks

- What user data Creditvana collects.

- How they store and protect user data.

- Regulatory compliance, transparency, trustworthiness.

8. Pros & Cons — Strengths and Weaknesses

- Clear list of advantages vs drawbacks based on current data/reviews.

- Use-case scenarios where Creditvana works best vs where it might not be a good fit.

9. Real User Reviews & Feedback — Testimonials, Complaints, Case Studies

- What actual users say about Creditvana (good/bad).

- Ratings, complaints, success stories.

- Patterns in feedback: reliability, payout speed, support quality, etc.

10. Alternatives to Creditvana — Competitors or Other Options

- Other services or products similar to Creditvana.

- How they compare — pricing, reliability, features.

- When an alternative might be a better fit.

11. Who Should Consider Creditvana — Target Audience & Use Cases

- Ideal user profiles (e.g. people needing quick credit, small businesses, etc).

- Scenarios where it makes sense vs where to avoid.

12. How to Get Started with Creditvana — Step-by-Step Guide

- Step-by-step instructions: sign-up, eligibility check, application, approval, use.

- Tips & recommendations to improve chances (documentation, credit history, etc).

13. Common Mistakes or Pitfalls to Avoid

- What users often get wrong (expectations, misuse, misunderstandings).

- How to avoid problems (read fine print, manage repayments, privacy cautions).

14. Frequently Asked Questions (FAQ)

- Q&A style section covering common doubts: “Is Creditvana legit?”, “How long does approval take?”, “What happens if I default?”, etc.

15. Final Verdict & My Recommendation

- Overall assessment: when Creditvana is worth considering, when to be cautious.

- Who it’s good for; who might be better off exploring alternatives.

Conclusion

Choosing the right credit card can feel overwhelming, especially with so many options, fees, rewards programs, and fine print to navigate. CreditVana simplifies that process by helping you compare credit cards based on your actual financial needs, spending habits, and long-term goals. Whether you want to build credit, earn cash-back rewards, lower your interest rates, or access premium travel benefits, CreditVana gives you a clearer, more personalized starting point.

As with any financial decision, the best results come from understanding your own goals and comparing multiple options before you apply. CreditVana makes this easier, but the final decision should always align with what works best for your budget and lifestyle.

If you’re ready to take the next step toward smarter credit decisions, using CreditVana can be a powerful way to find the best credit card for your situation — quickly, confidently, and with less guesswork. Empower your financial future by choosing a card that truly supports your needs.

If you want, I can also generate: